Fin-ancialisation 👷

WORK IN PROGRESS

The pillage of Thames Water and the implications for all of us

- “Financialisation ... a process in which making profits from financial instruments,such as the selling of bonds, grows more influential as a way of making profit than does trading in real products”

- Thames is just the worst - indebtedness is questioned ( and here) across the industry

- Burden of debt, interest, tax liabilities hidden in the offshore registrations of holding companies, extravagant services fees, and disproportionate salaries, bonuses, dividends - unnecessary expenses borne by the customers, while necessary investment and maintenance is under-funded.

- The results are intolerable for all life in our land and coastal waters.

- The abuse of monopoly supply has effectively gone unchecked by successive governments. We must correct this mess now. Different models and ways of funding are available. It’s time for the people to have their say.

https://www.theguardian.com/business/2023/jun/30/in-charts-how-privatisation-drained-thames-waters-coffers

https://www.theguardian.com/business/2023/dec/12/thames-water-apologises-to-mps-for-confusion-over-500m-loan

https://www.theguardian.com/business/nils-pratley-on-finance/2024/jan/03/thames-waters-owners-only-have-themselves-to-blame-for-the-write-downs https://www.theguardian.com/business/nils-pratley-on-finance/2023/jun/29/ministers-no-bailout-thames-water-backers

https://www.theguardian.com/business/2024/jan/02/thames-waters-second-largest-investor-slashes-value-of-its-stake

https://www.theguardian.com/business/nils-pratley-on-finance/2023/dec/12/thames-water-nationalised-ofwat-mps-customers

https://edhec.infrastructure.institute/wp-content/uploads/2024/01/Press_release_EDHECinfra_Thames_Water_Jan3.pdf https://publishing.edhecinfra.com/papers/2024_low_tide_research_paper.pdf

https://www.parliamentlive.tv/Event/Index/9a770fe2-13e4-4e79-919b-2c4375ce9ea7#player-tabs

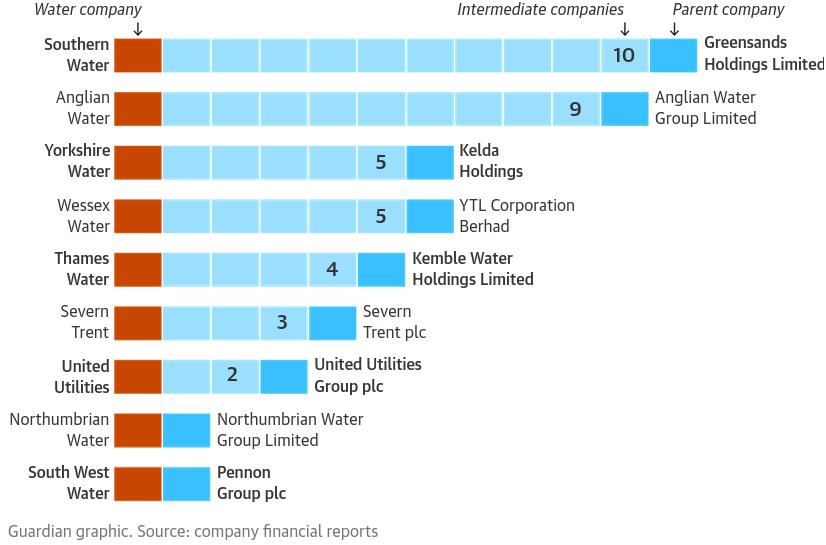

This is a Guardian graphic showing the ownership structures of English water companies: