Creating your event: Tickets and Payouts

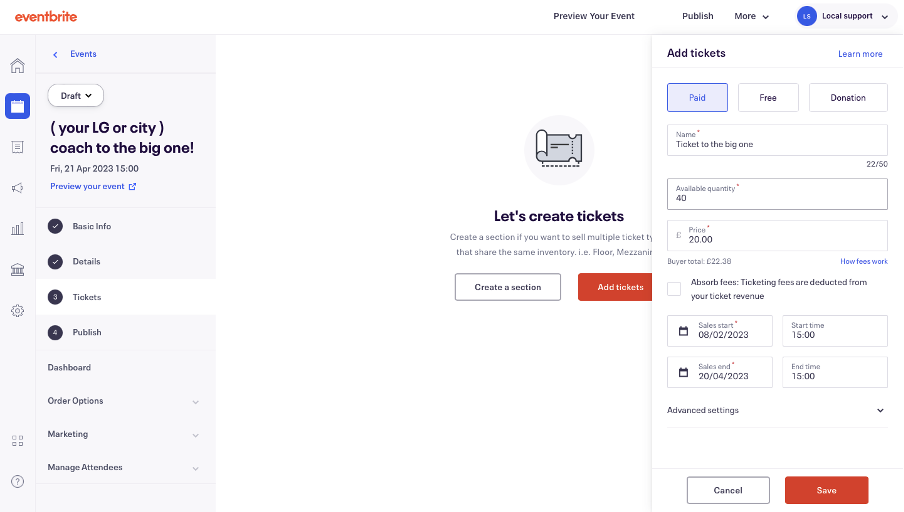

First click ‘add tickets’ on the left of your screen or in the middle of the screen, on the event dashboard. This will open up a section to the right on your screen.

If your event is free to attend, select the 'free ticket' box, or if it's paid click the 'paid' box.

In the ticket name, Give it a name, such as Ticket, or ticket to, or the type of ticket it will for, such as 'free', 'discounted ticket' and ect.

For the available quantity add the amount you have capacity for. You can break up that capacity across multiple ticket types if needed.

It is important that you do not select ‘absorb fees’ when setting up the event, as this will mean you will be paying for the fees even if the ticket gets refunded, this will affect your payout if this is a charged for event .

Make sure the currency is set to £ pounds and the country is set to the UK. Eventbrite payment processor should be automatically set.

You will then need to enter the time period the tickets will go on sale and an end time to stop selling tickets.

Once you have entered the name, amount of tickets, price of tickets (inclduding free) and time length for the sale of tickets, click save.

The payout from tickets sales

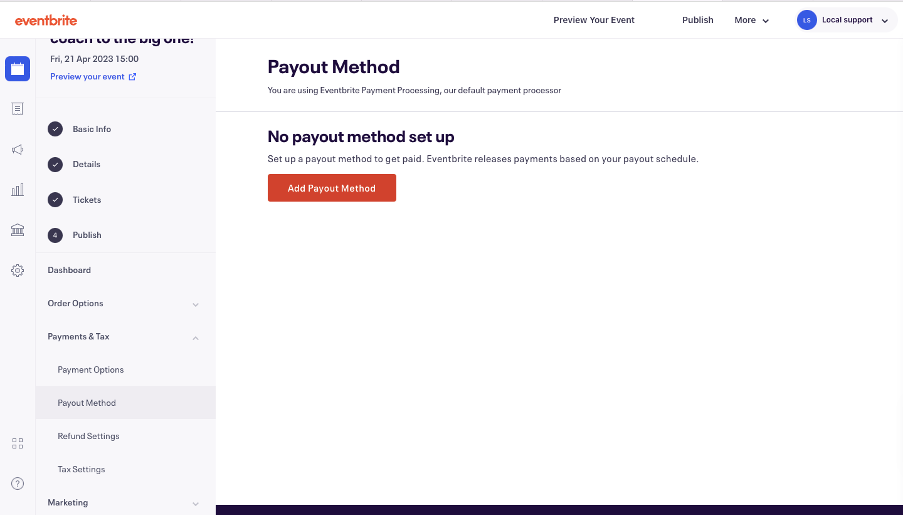

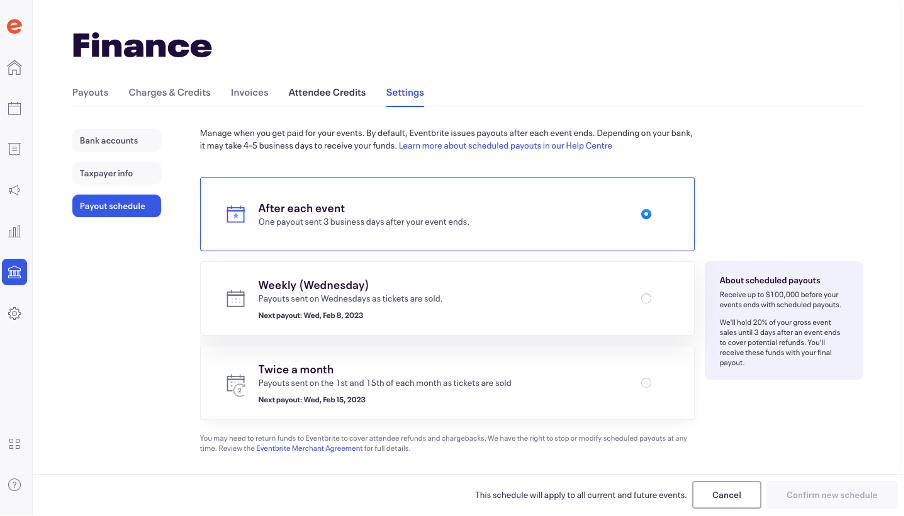

To get money back from the ticket sales, on the event dashboard/edit page and once you have set tickets up, go to the left-hand sidebar, click ‘payments & tax’ and then payment method. Then click the ‘Add Payout Method’. This will then ask you to enter your bank account details. Payouts happen automatically 3 days after the event. However, you can change this to every Wednesday or twice a month, however, Eventbrite will hold back 20% of the revenue from ticket sales.

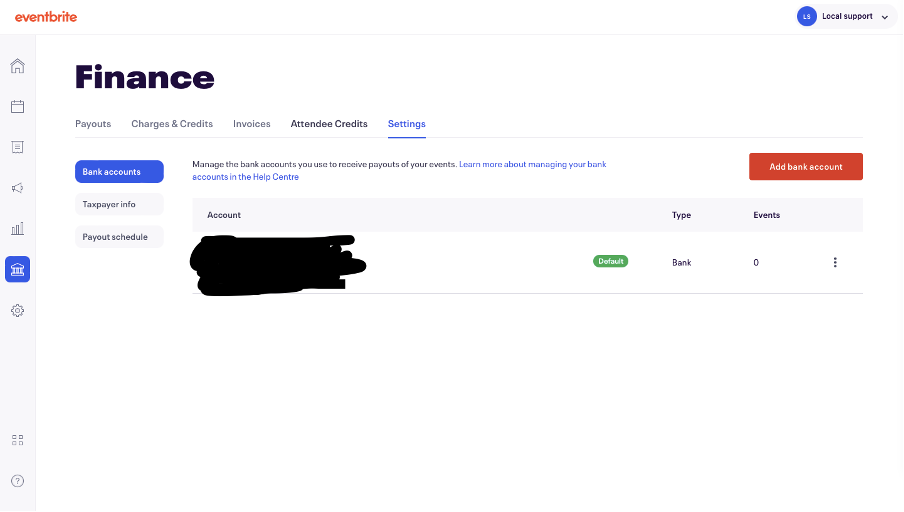

Once you have entered your bank account you will be sent the page below, to change the payout schedule, click ‘Payout Schedule’ that is on the left side of the screen.

From here you then can change the payout settings. This only works if you use Eventbrite default settings for payments.

Eventbrite charges VAT, so we don’t need to change or edit the tax settings.